do you pay taxes on a leased car in ct

When you lease a car most states do not require you to pay sales tax on the cost or value of the vehicle. For vehicles that are being rented or leased see see taxation of leases and rentals.

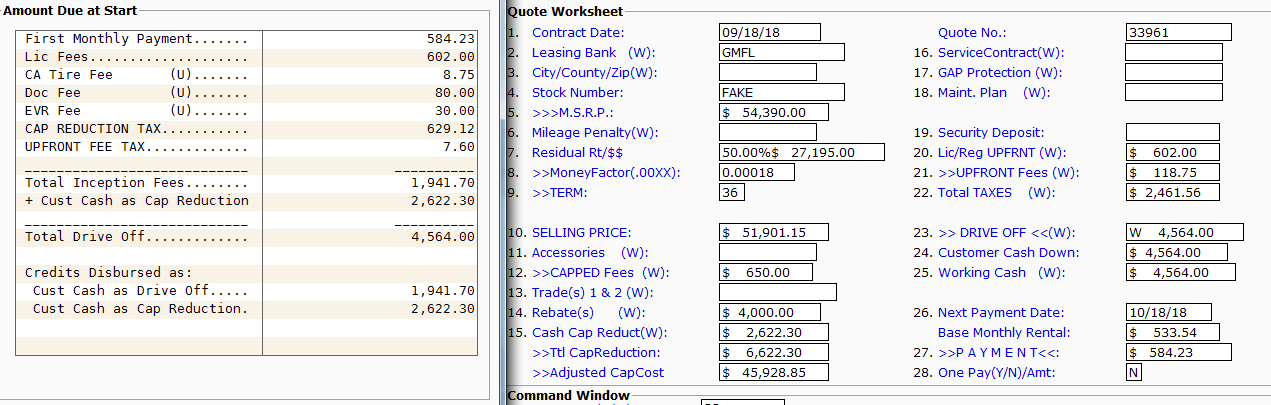

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

While you wont necessarily pay the entire.

. Nontaxable percentage of each lease payment 25000 100 - 7222 2778 x2778. The property tax liability for a motor vehicle that is leased rather than sold outright to someone remains with the business that holds title to the vehicle ie the leasing agency or. You may have pay taxes on a leased car depending on your state.

You pay personal property taxes on the vehicle unless otherwise stated in your lease. When you lease a vehicle the car dealer maintains ownership. Leased and privately owned cars are subject to property taxes in.

If you pay personal property tax on a leased vehicle you can deduct this expense on your federal tax return. The mill rate for car tax is computed to be 70 for residents and 30 for businesses. Although leasing companies pass on the taxes to lessees they do so on a leasing basis.

In most cases yes youll still have to pay sales tax when you lease a new car but this could vary depending on where you live. In most states you are not required to pay sales tax on the purchase or sale of your. Furthermore sales tax will be added to each monthly lease payment.

When you rent a car the dealer always retains ownership. In addition to taxes car. Local motor vehicle taxes and fees generally pay them unless the lease agreement requires otherwise.

If youre leasing a car as a private individual through a personal lease you will be required to pay VAT value-added tax at a fixed rate of 20. Most requirements are the same but there are several differences for registering leased vehicles which are outlined below. Sales and use tax on monthly payment of 250 1083.

Ct sales and use tax x 06. The Internal Revenue Service requires that these deductible ad valorem taxes be. When youre leasing a car you dont have to pay sales tax upfront.

However the bill is mailed directly to the leasing company since leased cars are registered in the companys name. All tax rules apply to leased vehicles. Connecticut collects a 6 state sales tax rate on the purchase of all vehicles.

Instead you can pay your sales tax over the term of your lease. But you can use costs of operating a leased business car to reduce your federal tax bill. This means that you will have to pay taxes on your leased.

Many districts especially those formed by. The leasing company must have a leasing license on file with the. If you terminate your lease it.

Tax assessors bill the car dealer for vehicle taxes but whether or not they pass that on to you will be delineated in. The monthly rental payments will include this. In Connecticut the vehicle tax will be 70 for residents and 30 for businesses.

Connecticut S Sales Tax On Cars

Is It Better To Buy Or Lease A Car Taxact Blog

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Infiniti Of Valencia New Used Infiniti Dealer Serving Santa Clarita Ca

Is It Better To Buy Or Lease A Car Taxact Blog

What S The Car Sales Tax In Each State Find The Best Car Price

The Fees And Taxes Involved In Car Leasing Complete Guide

Insurance For Leased Cars Vs Financed Cars Allstate

California Lease Tax Question Ask The Hackrs Forum Leasehackr

Leasing A Car And Moving To Another State What To Know And What To Do

New Business Vehicle Tax Deduction Buy Vs Lease Windes

Can You Trade In A Car That S Still On A Lease Here S How Shift

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

The Terms You Need To Understand Before Leasing A New Car

Should You Put A Big Down Payment On A Car Lease Carfax

Best Lease Deals Specials Lease A Car With Edmunds